INVESTMENT PHILOSOPHY

Our goal is to transform investments into wealth through portfolio management services that meet international standards, align with economic and market conditions as well as our expectations, and are tailored to every risk profile — becoming the portfolio management company of choice for investors.

At Emaa Blue Portfolio Management Inc., our investment processes are guided by the following core principles and approaches:

1. Long-Term Perspective:

We assess our investments based on their long-term growth potential rather than short-term market fluctuations. Our objective is to deliver sustainable returns for our clients over the long run.

2. Diversification:

To minimize risk and ensure more stable portfolio performance, we invest across different asset classes and sectors. Diversified portfolios provide protection against market volatility.

3. Sustainability:

We consider environmental, social and governance (ESG) criteria in our investment decisions. We aim to maximize both financial performance and social benefit with our sustainable and responsible investment approach.

4. Technology and Innovation:

We use the latest technologies and innovative approaches to support our investment decisions and optimize our processes. Advanced technologies such as data analytics and artificial intelligence strengthen our investment strategies.

5. Client-Centric Approach:

We develop investment products aligned with global market conditions that are tailored to our clients’ financial goals and risk tolerance.

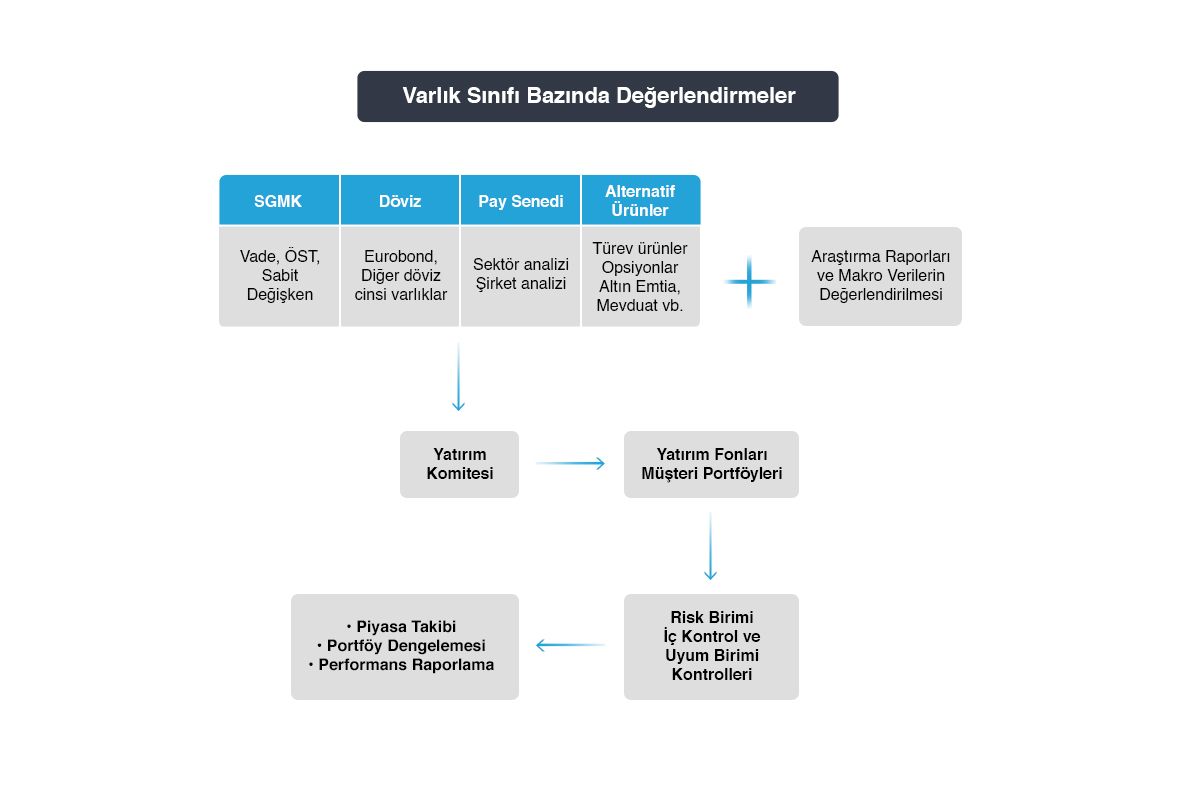

Our Investment Process:

Investment decisions are planned and implemented by considering the following stages:

Identifying the investor’s objectives, risk level, preferences, and constraints

Analyzing market expectations within the framework of macroeconomic developments

Constructing a portfolio structure in line with the risk level

Monitoring and rebalancing of portfolios

Performance measurement and reporting

Investment Committee – Defines the strategic asset allocations that form the basis of portfolio management during periodic meetings.

Portfolio Managers – Manage the portfolios in accordance with the decisions made by the Investment Committee.

Risk Management – Risks are measured using internationally recognized risk assessment methodologies.

Internal Control and Compliance – Ensures adherence to portfolio investment restrictions. If necessary, updates are made to portfolios.